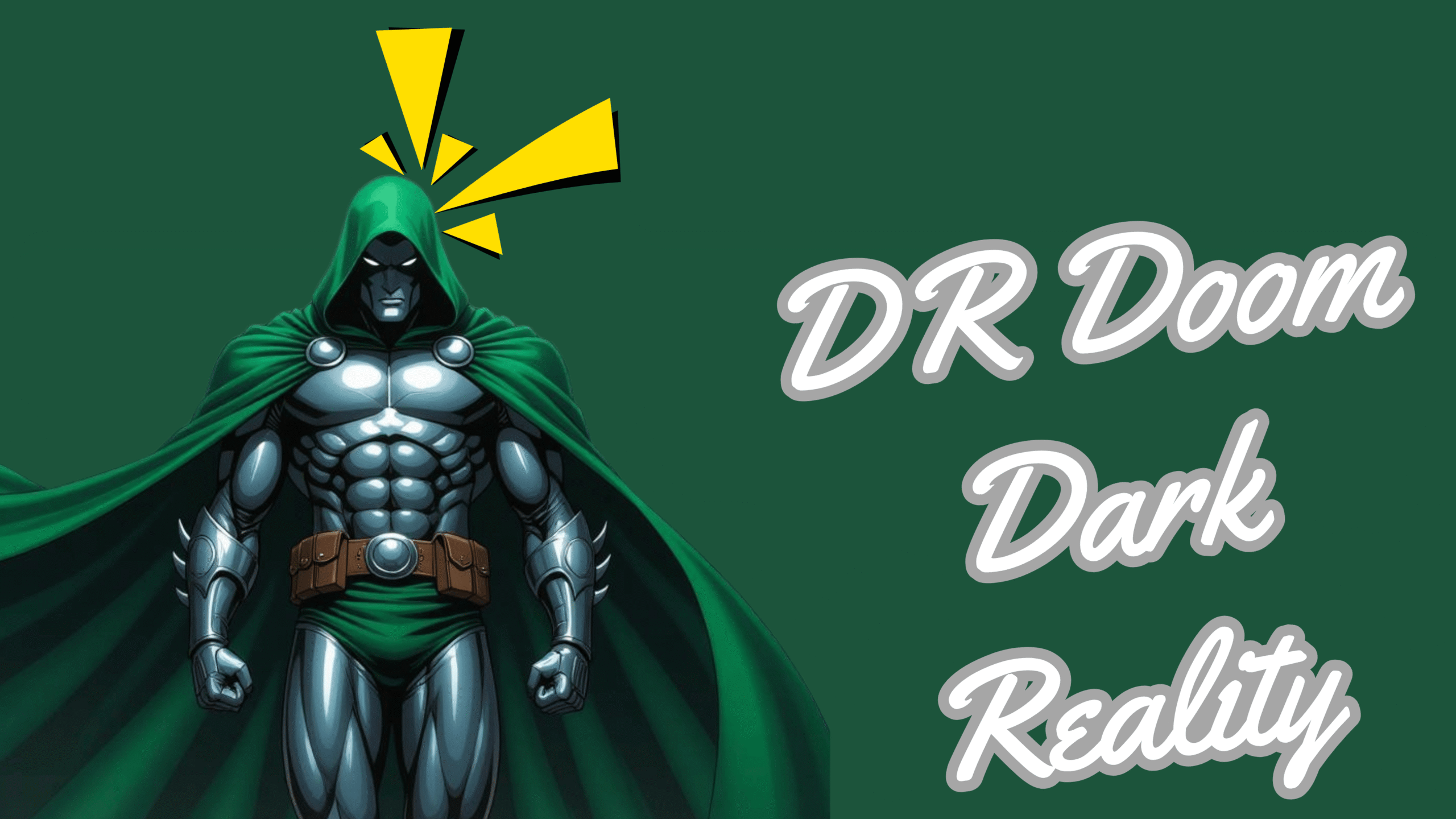

DC Comics’ Batman has been completely overhauled in the recently launched Absolute Universe, turning this well-off billionaire philanthropist into a struggling everyman hero whose brutal crime-fighting tactics have put his main continuity counterpart to shame. Set to take on a new version of Mr. Freeze in an upcoming issue of Absolute Batman, a variant cover for Absolute Batman #8 has given fans yet another official look at Absolute Mr. Freeze’s terrifying cryptid design, showing what Batman will be up against when Gotham freezes over.

Created in the aftermath of Darkseid’s shocking death, this brand new reality, dubbed the Absolute Universe, is a place where Batman, Superman, Wonder Woman, and the rest of the heroes and villains of the DC Universe, have been given revamped looks and updated origins, ushering in a new era of storytelling never-seen-before in DC continuity.

Following an explosive opening arc that saw Batman take on Absolute Black Mask and his Party Animals in a brutal war of attrition that rocked Gotham to its core, Absolute Batman, by Scott Snyder and Nick Dragotta, will introduce this reality’s Mr. Freeze next, with a new variant cover by Brian Bolland showing Absolute Mr. Freeze as an icy skeletal ghoul that barely looks human.

Mr. Freeze’s Redesign Turns Him Into Pure Nightmare Fuel in New Absolute Batman Variant Cover

Absolute Batman #8 Variant by Brian Bolland

Looking like an ice vampire with his skinny arms, bony back, pointed fingers, piercing red eyes, and blue-tinged skin, this goosebump-inducing art effectively teases what Mr. Freeze will look like in Absolute Batman #7, by Scott Snyder and guest artist Marcos Martín. Promising to introduce a “young, up-and-coming scientist named Victor Fries, his history with the Ark M experiment, and what it all has to do with the mysterious Joker,” this issue’s synopsis gives fans something to look forward to, with Brian Bolland’s appropriately creepy cover bringing his iconic Batman: The Killing Joke style into the Absolute Universe with ease.

Related

DC Teases Its “Scariest” Take on the Joker Yet as Absolute Batman Will Renovate the Villain

The Joker has always been a terrifying villain, but DC’s new Absolute Universe is transforming the Joker into something truly horrifying.

Like the previously released image of Nick Dragotta’s main Absolute Batman #8 cover, Victor isn’t wearing his patented cryogenic suit nor using any kind of cold-infused weapons in Bolland’s art, making fans wonder if this redesign has more going for it than being a simple nightmarish visual overhaul. Furthermore, it stands to reason that Absolute Mr. Freeze’s backstory will at least have a passing resemblance to his main continuity counterpart’s, with Victor’s transformation into a shambling ice creature likely happening thanks to a similar cryogenic mishap, turning the eventual reveal behind Freeze’s new design into an even more anticipated moment.

Absolute Mr. Freeze Is the Most Terrifying New Villain Absolute Batman Has Encountered Yet

Absolute Mr. Freeze Will Debut in Absolute Batman #7

While the details behind the true origin, motivations, and chilling redesign of this reality’s Victor Fries are still scarce, fans won’t have to wait long to see for themselves what’s in store for the Absolute Mr. Freeze, to say nothing about what kind of problems Batman will face once Gotham is blanketed in snow and ice, likely thanks to Freeze’s doing. Batman always has his work cut out for him when trying to thwart evil, especially in the Absolute Universe, and after seeing Brian Bolland’s take on the new Mr. Freeze, things don’t look like they’ll be getting any easier.

Absolute Batman #7 will be available from DC Comics on April 9, 2025.

Leave a Reply