Introduction: A Timeless Icon Blends Chic Prep Vibes with Unwavering Family Loyalty Envision crisp November streets in New York City,…

Read More

Introduction: A Timeless Icon Blends Chic Prep Vibes with Unwavering Family Loyalty Envision crisp November streets in New York City,…

Read More

Introduction: From Euphoria to Epic Fail – Sydney Sweeney’s Shocking ‘Christy’ Backlash Imagine training for months, packing on 30 pounds…

Read More

Introduction: When Love Meets the Spotlight in the City That Never Sleeps Picture this: The crisp November air in New…

Read More

Hey sports fans, have you ever had one of those nights where the action just doesn’t stop? From nail-biting finishes…

Read More

Hey there! If you’re curious about rising stars in entertainment who balance glamour with real-life wellness, Mariah Strongin is someone…

Read More

On the morning of November 3, 2025, a major incident unfolded on the UK’s West Coast Main Line when an…

Read More

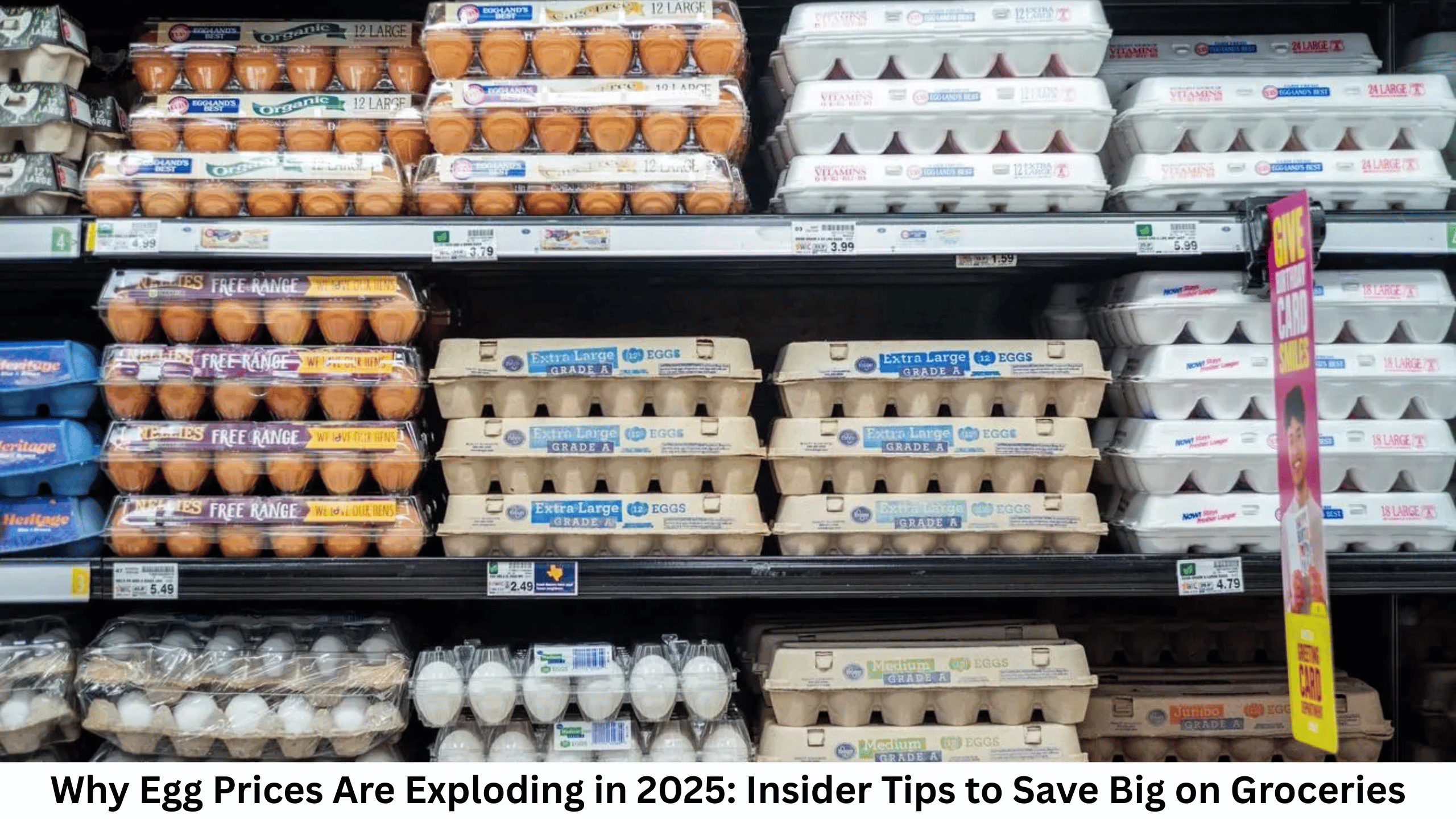

Imagine strolling down the grocery aisle, eyeing a carton of eggs that once cost $2.50 but now demands nearly $5—or…

Read More

The Rise of j-hope: From BTS Dancer to Global Solo Icon Let’s rewind a bit. j-hope—born Jung Hoseok on February…

Read More

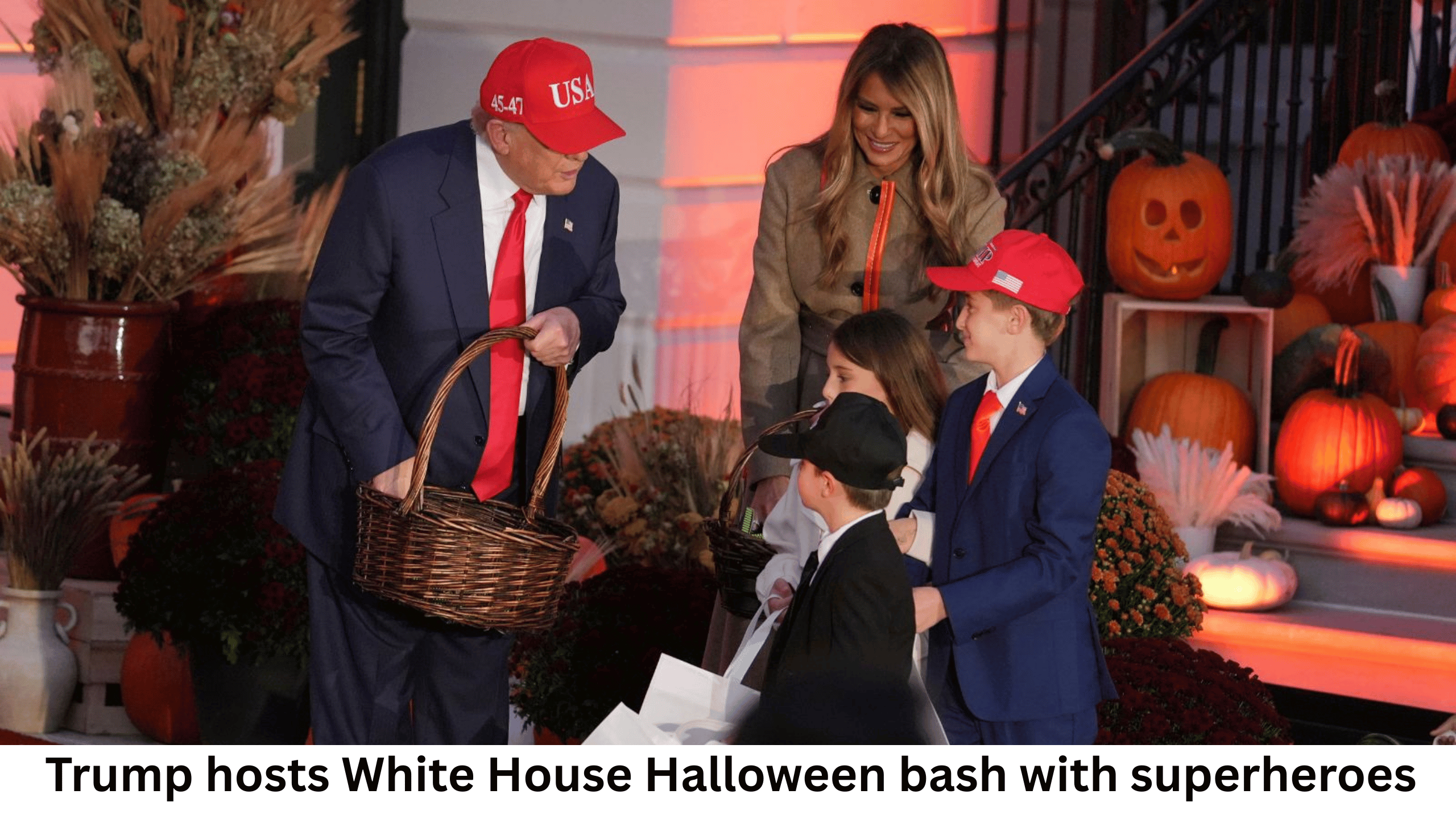

Can you believe Halloween 2025 has already come and gone? It feels like just yesterday we were carving pumpkins and…

Read More

Background on Erika Kirk Erika Kirk, widow of the late conservative activist Charlie Kirk, stepped into the public spotlight after…

Read More