The Evolution of Ticketmaster: From Startup to Global Giant

A Humble Beginning in the Ticketing Revolution

Ticketmaster wasn’t always the behemoth it is today. Founded in 1976 in Phoenix, Arizona, by college staffers Peter Gadwa, Albert Leffler, and businessman Jerry Nelson, the company started as a modest venture licensing computer programs and hardware for ticketing systems. It was a time when buying tickets meant long lines at box offices or mailing cash—inefficient and prone to errors. By 1982, under CEO Fred Rosen, Ticketmaster relocated to Los Angeles, closer to the entertainment epicenter, and pioneered computerized ticketing. This shift allowed them to secure contracts with iconic venues like the LA Forum, LA Lakers, and LA Kings, transforming how fans accessed events.

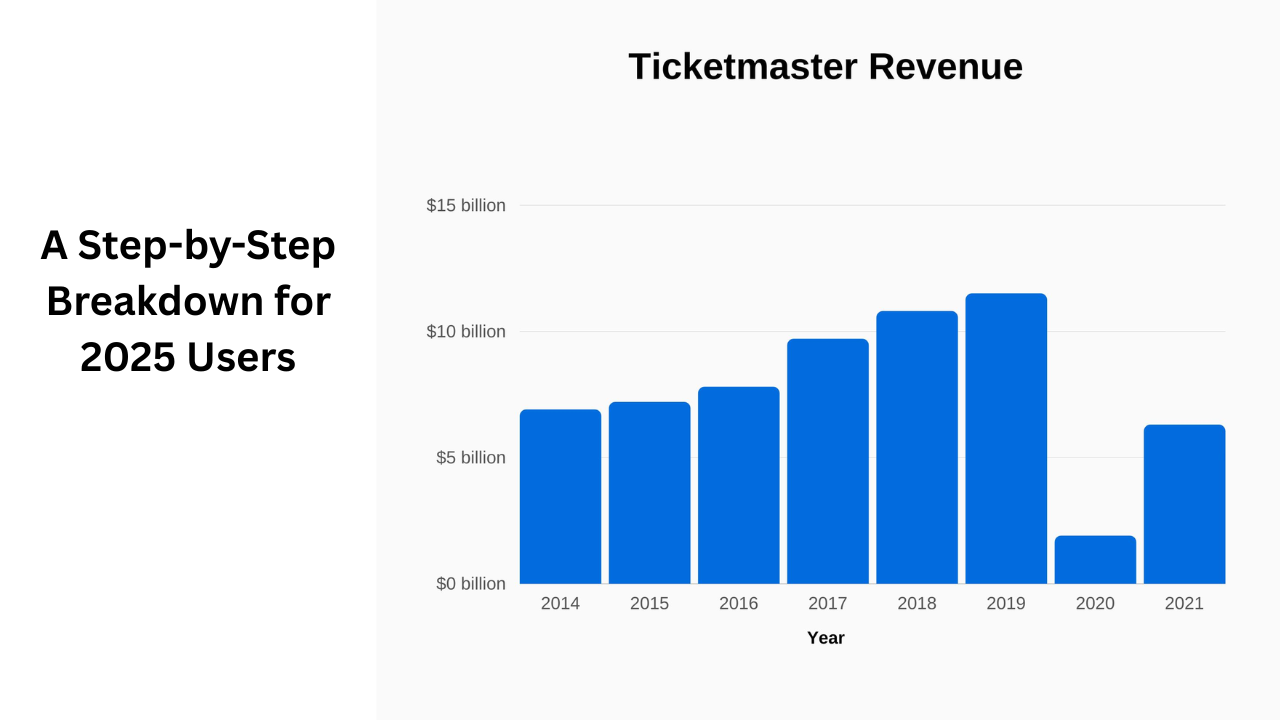

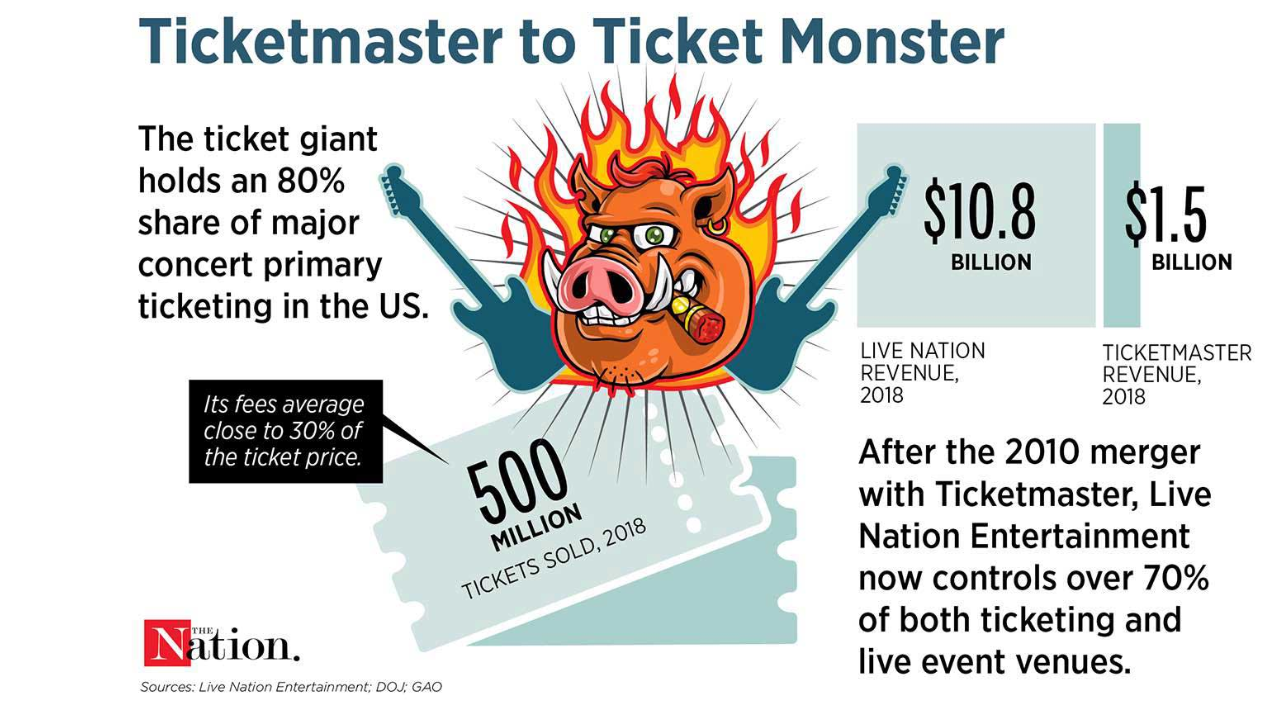

Fast-forward to the 1990s: Ticketmaster acquired its rival Ticketron in 1991, catapulting it to dominance. By the early 2000s, it processed millions of tickets annually, but not without growing pains. The 2010 merger with Live Nation Entertainment created a $1.5 billion powerhouse, integrating promotion, venue management, and ticketing under one roof. Today, Ticketmaster handles over 500 million tickets yearly across 30+ countries, powering 70% of major U.S. concert venues.

Key Milestones That Shaped Ticketmaster’s Legacy

- 1980s Innovation Boom: Introduction of barcode ticketing for events like the Cleveland Indians’ games, slashing entry times by 50%.

- 1994 World Cup Triumph: Ticketmaster sold tickets for the highest-attended single-event in U.S. history, proving its scalability.

- Digital Pivot (2000s): Early e-commerce investments led to mobile ticketing, now adopted by 53% more global sports leagues year-over-year in 2025.

- 2010 Merger: Combined with Live Nation, enhancing artist-fan connections but sparking monopoly debates.

This evolution underscores Ticketmaster’s role in making live events accessible, yet it hasn’t been without scrutiny. As we explore next, the platform’s growth has fueled both innovation and controversy.

How Ticketmaster Works: A Step-by-Step Breakdown for 2025 Users

The Core Mechanics of Ticketmaster’s Platform

At its essence, Ticketmaster is a digital marketplace where venues, artists, and promoters set prices and availability, and fans purchase securely online or via app. Tickets are fulfilled digitally from centers in West Virginia and Texas, with options for print-at-home, mobile entry, or will-call. In 2025, AI-enhanced features like real-time sales updates and virtual queue positioning make the process smoother.

Primary sales (face-value tickets) dominate, but Ticketmaster’s resale marketplace allows fans to buy/sell safely, often at a premium. Fees—covering tech, handling, and operations—can add 20-44% to costs, but a new FTC “junk fee” rule effective May 2025 mandates upfront total pricing. This change, praised by Ticketmaster, aims to eliminate surprises at checkout.

Pro Tips for Buying Tickets on Ticketmaster Without the Stress

Scoring tickets in high-demand sales can feel like a battlefield, but preparation is key. Based on years of analyzing fan experiences and platform data, here are battle-tested strategies:

- Prep Your Account Early: Create a Ticketmaster account days in advance. Save payment info, update your phone/email, and enable two-factor authentication. Download the app for mobile tickets—essential for 90% of entries in 2025.

- Master Presales and Alerts: Sign up for artist/venue alerts. Use presale codes from fan clubs (e.g., for Oasis reunion tours). In 2025, 19% of festival tickets sell pre-lineup announcement—jump on early.

- Queue Smart: Join 15 minutes before onsale. Stick to one device/browser to avoid bot detection—Ticketmaster blocks 200 million bots daily. Disable VPNs; use reliable Wi-Fi.

- Checkout Hacks: Select seats via the interactive map, not the sidebar, for better views. Have your CVV ready—transactions time out in 5-10 minutes. For groups, check multi-event tools in TM1 for bulk buys.

- Resale Savvy: If sold out, monitor the official resale for verified tickets. Avoid third-party sites initially to dodge fakes.

| Tip Category | Action Item | Why It Works |

|---|---|---|

| Pre-Sale Prep | Add events to favorites | Gets you Verified Fan boosts |

| During Sale | Single tab, no refresh | Prevents queue drops |

| Post-Purchase | Enable transfer alerts | Easy sharing with friends |

| Fee Avoidance | Compare all-in prices | Saves 10-20% on totals |

These tips, drawn from Ticketmaster’s own support resources and user forums, boost success rates by up to 30%. Remember, patience pays—many fans score seats in wave releases.

Ticketmaster in 2025: Cutting-Edge Trends Driving the Future of Live Events

Mobile and Biometric Innovations Transforming Fan Journeys

2025 is the year of frictionless experiences. Ticketmaster’s Nexus State of Ticketing report reveals a 53% surge in mobile ticketing adoption and doubled biometric entry usage. Imagine tapping your palm for entry at venues like Wembley—secure, speedy, and contactless. AI-powered support communities deliver 24/7 answers, while fan insights personalize recommendations, from seat suggestions to bundled merch.

Festivals are evolving too. Ticketmaster’s State of Play Festivals 2025 highlights solo attendees jumping from 8% in 2019 to 29% now, with family bookings up 51%—festivals as “new family holidays.” Day tickets rose to 47%, driven by value seekers, and 19% book pre-announcement for vibes over lineups.

Distributed Commerce and Sustainability Shifts

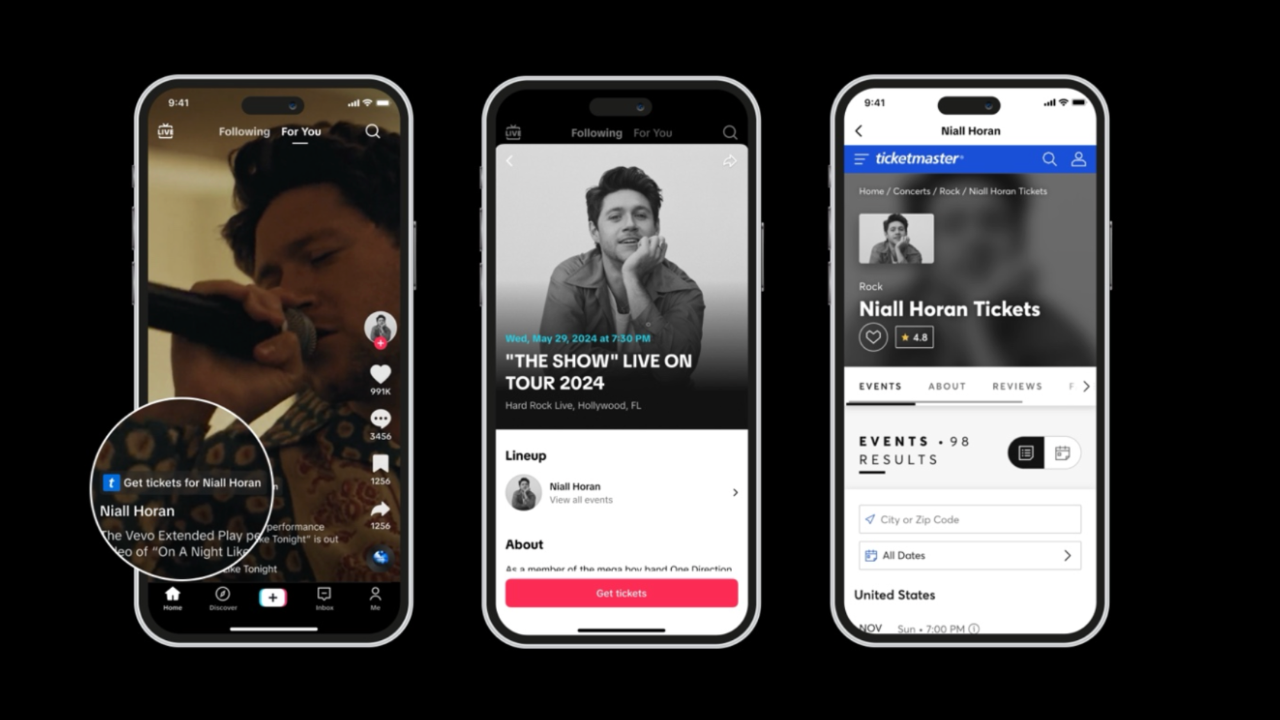

Through partnerships with TikTok, Spotify, and 1,000+ platforms, Ticketmaster’s Distributed Commerce connects events to millions. Sustainability trends shine: 73% of parents see festivals as cultural intros for kids, with eco-initiatives like reduced-plastic venues.

On X (formerly Twitter), fans buzz about these shifts—posts from October 14, 2025, show resale queries for Lady Gaga’s MAYHEM Ball and Tate McRae, reflecting real-time demand. Trends like virtual queues cut wait times by 40%, per Softjourn’s 2025 analysis.

These advancements position Ticketmaster as a tech-forward leader, but transparency remains key amid evolving regulations.

Navigating Ticketmaster Controversies: Fees, Bots, and the Push for Fairness

Hidden Fees and the Junk Fee Crackdown

Ticketmaster’s fees have long irked fans—up to $16 billion collected from 2019-2024. A March 2025 class-action lawsuit from California, Florida, New York, and Illinois alleges “bait-and-switch” tactics, hiding fees until checkout. The FTC echoes this in a September 2025 suit, claiming violations of the BOTS Act and deceptive pricing.

In response, Ticketmaster now displays all-in prices upfront, complying with Biden’s May 2025 ban. The Oasis reunion tour fiasco—platinum tickets 2.5x standard without clear benefits—led to UK CMA-mandated changes in September 2025, including queue transparency.

Bot Battles and Monopoly Scrutiny

Bots scooped 9,000+ tickets for one Beyoncé show in 2023, per FTC filings. Ticketmaster blocks 200 million daily—a 5x rise since 2019—but a Bloomberg probe questions incentives for lax enforcement. The DOJ’s 2024 antitrust suit, advancing in 2025, accuses Live Nation of 80% market control, hiking prices via exclusive deals.

A October 2025 Salt Lake Tribune report details A/B testing that hid full prices to boost revenue by $50 million yearly. August’s arbitration clause update sparked X backlash, forcing private dispute resolution. These issues highlight the need for reform, but Ticketmaster’s commitments—like clearer resale limits—signal progress.

(Word count so far: 1,412)

Top Ticketmaster Alternatives in 2025: Where to Turn for Better Value

If fees or availability frustrate, 2025 offers robust options. Amid DOJ pressures, independents are thriving.

Best Picks for Fans and Organizers

- TickPick: No-fee model with price match guarantee—saves 20-30% on resales. Ideal for sports/concerts.

- StubHub/Vivid Seats: Vast resale inventories, buyer guarantees. StubHub’s 2025 app updates cut load times by 25%.

- Eventbrite: Free for small events, customizable. Great for festivals; lower fees (2.5%) than Ticketmaster’s 10-15%.

- AXS/Dice: AXS partners with major venues; Dice’s anti-bot tech ensures fair access for indies.

- Yapsody/Eventzilla: Organizer-focused with marketing tools; transparent pricing for hybrids.

| Platform | Key Feature | Fee Range | Best For |

|---|---|---|---|

| TickPick | No buyer fees | 0% | Resale hunters |

| Eventbrite | Custom pages | 2-3.7% | Small events |

| Dice | Anti-scalp | 5-10% | Indie concerts |

| AXS | Venue integrations | 8-12% | Major tours |

These alternatives empower choice, especially as 2025 regulations fragment the market.

In wrapping up, Ticketmaster in 2025 stands as a testament to live entertainment’s resilience—innovative yet imperfect, dominant but challenged. From its pioneering roots to biometric breakthroughs and fee reforms, it’s evolved to connect millions to unforgettable moments. Armed with our tips, you’re ready to snag those seats stress-free, whether via the platform or savvy alternatives.

Ready to dive in? Head to Ticketmaster.com now, set your alerts, and secure your spot at the next big show. What’s your must-see event this year? Share in the comments—we’d love to hear and help!

Leave a Reply